A mere decade ago, a coffee shop commanded attention if it offered Wi-Fi for its tech-savvy customers; today, this same business would be long-since shuttered if it failed to offer this basic ingredient of the digital age for all of its patrons — not just the geeks. The same now goes for marinas, yacht clubs and charter yachts, as today’s boaters increasingly demand more connectivity and higher bandwidth for online uses ranging from social media updates to streaming cloud-based media to making Voice over Internet Protocol (VoIP) phone calls and videoconferencing. Yet while most consumer-facing businesses now provide Wi-Fi, ensuring fast, reliable service on a globe-girdling yacht is far more complex than simply plugging in a modem and wireless router.

Mariners have been using Very Small Aperture Terminal (VSAT) technology to send and receive data communications via satellite since the late-1970s, and these constellations have evolved with each successive generation. While early “satcom” services focused their coverage on near-coastal and terrestrial zones (VSAT primarily facilitates land-based needs like credit-card transactions), service providers began aiming their satellite beams offshore roughly 10 to 15 years ago, considerably expanding their global coverage. VSAT satcom networks use various radio-frequency bands (i.e., Ku-band) to provide different coverage footprints, network capacity and levels of performance, the latter of which is measured as uplink (transmit) and downlink (receive) speeds and notated as kilobytes or megabytes per second (kBps or mBps).

Recent decades have seen an evolution of technologies and maritime frequency bands, starting with C-band (4 to 8 GHz) and progressing through L-band (1 to 2 GHz) and Ku-band (12 to 18 GHz) service, which offers sufficient bandwidth for data and VoIP calls, but which is sluggish when compared to at-home broadband Internet speeds. Now, British mobile satcom giant Inmarsat reports that it will be helping to close this yawning crevasse when its brand-new, $1.6 billion, Ka-band (26.5 to 40 GHz) Global Xpress (GX) constellation — and its mariner-specific Fleet Xpress service — comes online sometime in mid-2015.

“GX will be the first, and only, global Ka-band high-speed broadband network,” said Peter Broadhurst, Inmarsat’s vice president, about the new service that’s specifically being built for nonstationary users (e.g., maritime and aviation). “GX is designed to deliver seamless, real-time communications between vessels at sea and their offices on land, and enhanced communications and entertainment options” for crew members. Inmarsat’s published goal is to deliver GX uplink/downlink speeds of up to 5 mBps/50 mBps respectively — a considerable advancement over Inmarsat’s current FleetBroadband L-band service, which delivers uplink/downlink speeds of 150 to 432 kBps, depending on the size of the terminal (industry parlance for antennas) being used, with larger antennas delivering the faster speeds.

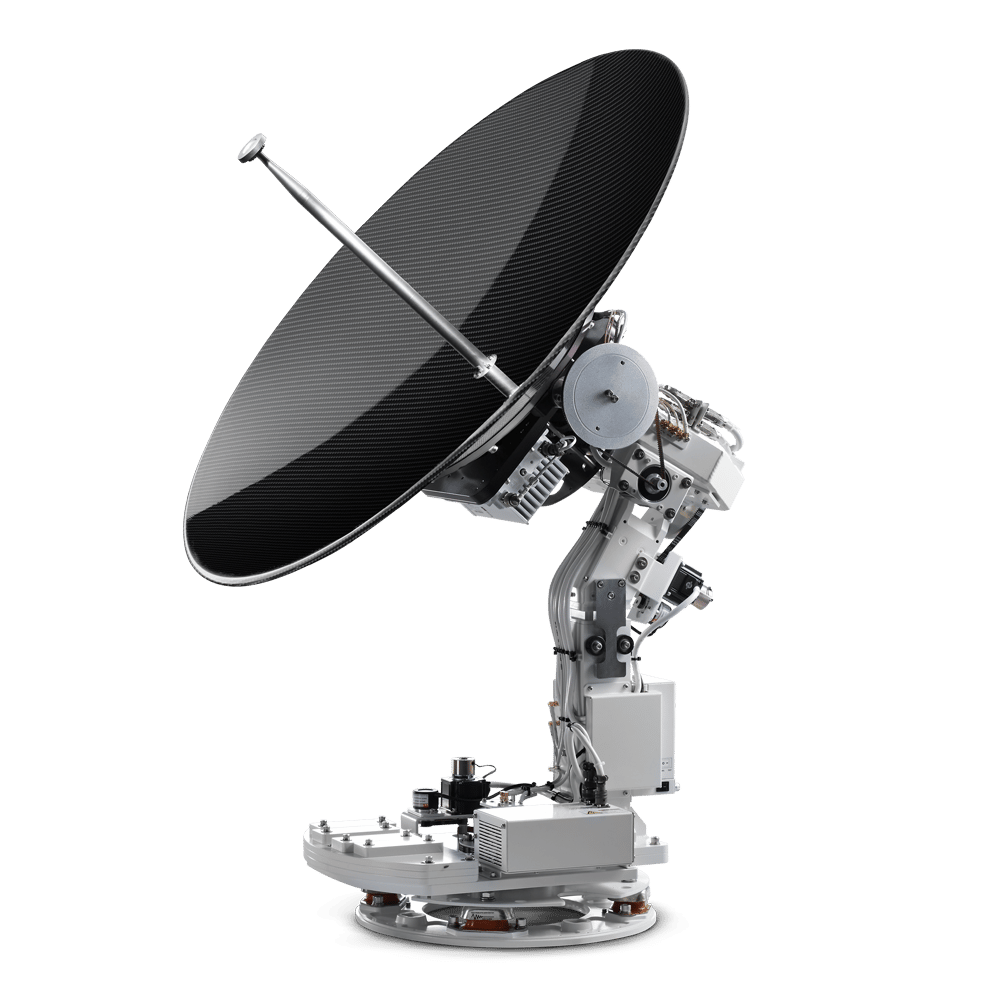

The GX constellation, which is solely owned and managed by Inmarsat, will consist of three geostationary Boeing 702HP satellites that will operate on the new Ka-frequency band. “Inmarsat-5 F1” was launched on Dec. 8, 2013, in Kazakhstan and entered regional service — supplying Ka-band coverage to Africa, Asia, Europe and the Middle East as part of the interim FleetBroadband Xtra service (Ka- and L-band service), which is a temporary GX/FX placeholder — on July 1, 2014. Two additional I-5s are expected to be operational shortly, and Broadhurst anticipates that GX service will be online by late summer or early fall. A fourth satellite will serve as a spare in the event of a launch failure, or as a means of potentially increasing network capacity and coverage. While the GX program has suffered some setbacks, most notably the May 2014 launch failure of a Russian-built Proton rocket, Inmarsat is confident that GX’s projected upsides — including higher-speed performance through smaller-size and less-expensive terminals — outweigh the delay. (GX terminals are currently offered in 60-centimeter and 1-meter sizes, Broadhurst said; 1-meter antennas will deliver twice the committed information rate for the same service fee as 60-centimeter terminals.)

Additionally, the new constellation will be supported by six GX-specific satellite access stations (SAS), which are in Canada, the United States, Italy, Greece and New Zealand (which will host two SAS installations). “Each SAS delivers full ground-segment redundancy for GX services, [providing] high-quality resiliency, reliability and availability, for example at times of adverse weather, and [offers] a powerful differentiator to traditional regional Ku-band networks,” Broadhurst said.

For mariners, Inmarsat will introduce Fleet Xpress (FX), which is a managed maritime service services to provide high-speed global coverage (sans extreme polar regions). Broadhurst said FX will provide uplink/downlink speeds of 4 mBps/16 mBps, with bespoke options available. Additionally, FX will give customers access to marine-specific content and applications (e.g., chart downloads and weather-routing services) from a centralized source, which is ideal for charter services or organized events. “Telemedicine, safety updates, remote access, media access and vessel monitoring will become effective services,” Broadhurst said.

Here it is important to understand GX’s capabilities, as well as its challenges. For example, Ka-band signals are prone to rain-induced attentuation issues, which can hamper GX speeds and reliability, especially in the tropics or other areas with extreme precipitation. Also, each geostationary Inmarsat-5 GX satellite will be equipped with 89 spot beams, of which 72 beams can be powered at any given time. Because of both the rain attenuation concern and the fact that at any given point 81 percent of the spot beams are active, Inmarsat offers mariners FX service that bundles FleetBroadband signals to fill in potential coverage gaps. This setup requires that users carry both GX and FleetBroadband systems.

Still, GX and FX should provide quicker speeds than Inmarsat’s FleetBroadband service, albeit for a premium price, making it initially suited to the superyacht, charter and Internet-junkie crowds. Moreover, GX and FX were designed to provide seamless service as users transition from one coverage beam (or satellite) to the next, enabling constant connectivity — a crucial digital salve for crew members, guests and owners, and a vital lure for information-starved millennials.